Company Overview

Zomato operates a food delivery platform that executed 647.0 million orders for 58 million annual transacting customers in FY23. The company's ecosystem includes Blinkit, a quick commerce service, and Hyperpure, a B2B initiative that enhances the restaurant supply chain by providing fresh, quality ingredients directly from the source.

Industry Outlook

India had 692.0 million internet users with a 48.7% internet penetration rate as of early 2023.

The Online Food Delivery market in India is forecasted to generate revenue of $43.78 billion in 2024, expanding to $81.91 billion by 2028.

The projected Average Revenue Per User (ARPU) in the Grocery Delivery market in India is expected to be $183.40 in 2024.

The Meal Delivery market in India is anticipated to reach 346.6 million users by 2028.

Historical Performance

Revenue grew at a 5-year CAGR of 72% for the period ending FY23, reaching INR 7,079 Cr.

In Q3FY24, the company turned profitable with an adjusted net profit of INR 138 Cr.

Zomato had 80 million monthly active customers as of March 2023.

Key Drivers and Investment Thesis

Strong Operational Performance: The management has guided the improvement of EBITDA margins for both the Food Delivery and Quick Commerce businesses.

Rapid Growth in Quick Commerce: Blinkit's revenue has doubled over the last year, and the segment is expected to grow at a 45% CAGR over the next 3 years.

Profitability in Food Delivery: Zomato is optimizing delivery costs, enhancing revenue through increased order volume/value, and strategic commission rates. Diversification into related services and investment in technology and automation further support profitability.

Platform Fee Revenue: The introduction of the platform fee is projected to generate an estimated revenue of approximately INR 3,000 Cr. in FY26 without adversely affecting demand elasticity.

Growing Gold Membership: The increasing gold membership base signifies an investment in long-term customer loyalty and engagement.

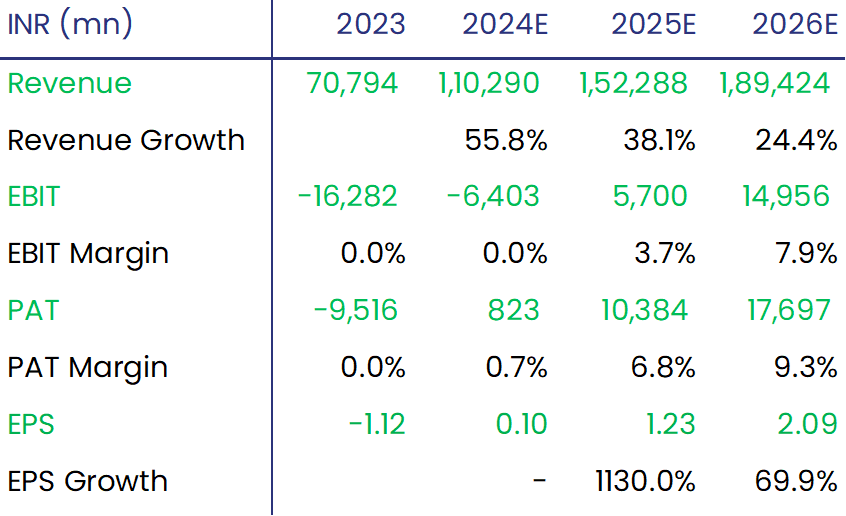

Financial Analysis and Valuation

Based on our revenue growth and cost of equity assumptions, we estimate an intrinsic value of INR 202 for Zomato's stock, suggesting a potential upside of 40% within the next 12-18 months.

Revenue Growth Assumptions:

Food Delivery Business: 45% for FY24, 30% for FY25, and 20% for FY26; FY25 EBITDA Margins at 6.7%

Quick Commerce Business (Blinkit): 75% growth for FY24, 50% for FY25, and 30% for FY26; FY25 EBITDA Margins at 6.5%

10% terminal growth rate

Cost of Equity Assumptions:

Beta: 1

Risk-free Rate: 7.2%

Risk Premium: 8.33%

Recommendation

We recommend a "Buy" rating for Zomato Ltd., considering its strong market position, strategic initiatives, and growth prospects in the food delivery and quick commerce sectors. The company's focus on profitability, expanding customer base, and diversification efforts make it an attractive investment opportunity in the rapidly growing digital economy of India.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.