About the Company

SJS Enterprises is a diversified manufacturer specialising in aesthetic and functional products for various industries. Their product range includes decals, body graphics, 2D and 3D appliques, badges, overlays, in-mould labels, lens mask assemblies, and various injection moulded plastic parts. The company serves sectors such as automotive (two-wheelers, passenger vehicles, commercial vehicles), consumer durables, medical devices, farm equipment, and sanitary ware. SJS has exported products since 1996 to global companies including Motorola, Hewlett Packard, Visteon, Honda, TVS, Tata Motors, and Whirlpool. The production facilities are located in Bangalore, Pune, and Manesar. The company serves over 180 customer locations across 22 countries with a workforce of approximately 2,300 employees. In FY24, it supplied more than 169 million parts across 7,000+ SKUs.

It acquired Exotech Plastics in 2021, expanding its product portfolio and strengthening its manufacturing capabilities in plastic components. SJS also acquired a 90.1% stake in Walter Pack Automotive Products India Private Limited (WPI), a subsidiary of Walter Pack Spain known for designing and developing value-added decorative parts for the Indian automotive market.

FY24 Performance

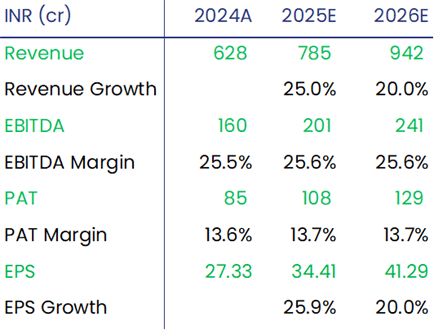

Total Revenue (incl. Other Income) at INR 635.5 Cr. v/s INR 443.2 Cr. in FY23 (+43.4% YoY)

EBITDA at INR 159.9 Cr. v/s INR 117 Cr. in FY23 (+36% YoY)

EBITDA Margins at 25.2 % v/s 26.4 % in FY23 (-120 Bps YoY)

PAT at INR 85.4 Cr. v/s INR 67.2 Cr. in FY23 (+27.1% YoY)

Promoter Analysis

K A Joseph (Managing Director)

He holds 21.55% of the company.

He was the Co-founder of the company in 1987

34+ years of experience in the aesthetics printing business

Postgraduate diploma in business administration from the St. Joseph’s College of Business Administration, Bangalore; B.Sc. from Bangalore University

Sanjay Thapar (CEO & Executive Director)

30+ years of experience in the automotive industry

Previously worked with Ashok Minda Group, Minda Valeo Security Systems, Minda HUF Limited, Tata Engineering and Locomotive Company Limited (now known as Tata Motors Limited)

Bachelor’s degree in science (Mechanical Engineering) from the Delhi College of Engineering

Industry Outlook

According to a Report, the industry is projected to grow by ~20% CAGR to reach INR 4920 Cr. by FY25-26, driven by increased application segments and growing demand for premium aesthetic products.

SJS Enterprises, a supplier of decals for both two-wheelers (2W) and four-wheelers (4W), stands to benefit directly from growth in the automobile industry. By 2026, the automobile component sector will become a major contributor to India's GDP, adding between INR 10 lakh Cr. to INR 15 lakh Cr.

In FY24, the Passenger Vehicle (PV) segment (which SJS counts as major customers) recorded robust sales of 4.3 million units, up from 3.9 million units in fiscal 2023, marking a 10% growth, according to the Society of Indian Automobile Manufacturers (SIAM).

Key Driver and Investment Thesis

Strategic Acquisitions

SJS acquired Walter Pack India (WPI) which increased its content per vehicle for cars from INR 1,200–1,500 to INR 3,500–5,000, driven by new products like wheel caps, aluminum badges, IML interiors, and optical plastic/touch components. Looking ahead, SJS plans to increase the value of scooter kits from INR 300–500 to INR 1,200–1,500 and enhance its offerings with optical glass/touch screens, IMD/IML overlays, and printed electronics for TVs, fridges, and washing machines.

Ambitious Capex Plans

For FY25, a capex of ~INR 60-70 Cr. is planned. This expenditure will include a maintenance capex of ~INR 20 Cr. and the remaining funds will be used for expansion. Looking ahead, over FY26/27, SJS Enterprises projects a total capex of INR 160 - 170 Cr.

Strong Order Book for FY25

SJS Enterprises has secured an order book that covers 85% of its projected revenue for FY25, assuming an overall industry growth of 8% to 10%. This estimation is based on detailed insights into specific models and the performance of various OEM segments, highlighting the company's diverse product range.

Aims for Superior Industry Growth

SJS Enterprises anticipates exceeding the industry growth rate by over 1.5x, driven by several key factors: premiumisation, the development of major OEM accounts, expanded export opportunities, and strategic acquisitions

Robust Margin Profile While Driving Growth

SJS Enterprises plans to maintain a robust margin profile for FY25 and beyond, targeting an EBITDA margin of 25.2% as it balances higher growth with margin stability over the next three years.

Valuations and Recommendations

While the current PE multiple for SJS is ~30x, we conservatively value SJS at 25x FY2026E Earnings Per Share (EPS), with a target price of INR 1037.

We assign a “Buy” Rating to SJS with an upside of 35% in the next 12-18 months on the basis of superior growth, sustainable margins, and steady order book.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.