About the Company

Incorporated in 2020, Cellecor Gadgets Limited is the First Indian Consumer Electronics company to go public. Founded by Mr. Ravi Agarwal, a first-generation entrepreneur the company began its journey in 2010 as Unity Communications, a proprietorship firm. Unity Communications business was transferred into Cellecor Gadgets, a fast growing player in India's affordable consumer electronics market. The company has a diverse product portfolio, including mobile phones, smart TVs, audio devices, and recently expanding into home appliances. Cellecor leverages a vast distribution network of 1,000+ distributors and 32,000+ retailers across 15+ states, complemented by growing online sales channels. Initially focused on feature phones, Cellecor strategically expanded its product portfolio to include smartwatches, TWS earbuds, neckbands, and LED TVs, all sourced from various electronic assemblers and manufacturers. The company currently has 10+ categories of products with 350+ SKUs.

Since its inception, Cellecor has experienced significant growth, fueled by a commitment to innovation and a deep understanding of the Indian market. A key milestone was the company’s successful listing on the NSE EMERGE platform in September 2023, raising INR 50.8 Cr. through its IPO.

CGL announced a 10:1 Stock Split on June 26th, 2024 and the record date is set on 9th August.

FY24 Financial Performance

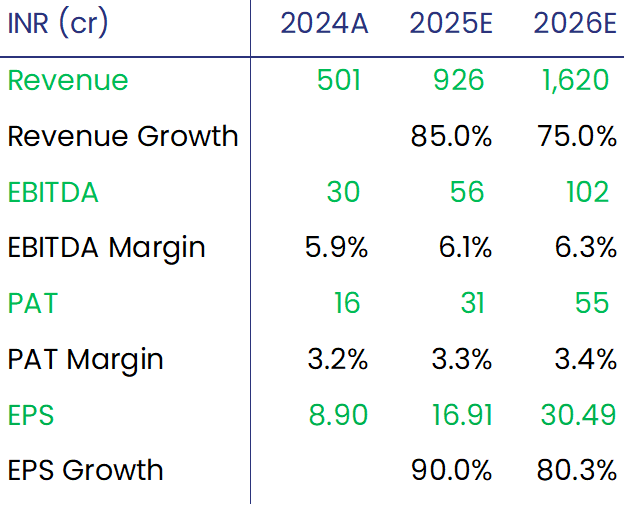

Total Revenue at INR 500.5 Cr. v/s INR 264.4 Cr. in FY23 (+89.33% YoY)

EBITDA at INR 29.65 Cr. v/s INR 12.57 Cr. in FY23 (+135.93% YoY)

EBITDA Margins at 5.9% v/s 4.8% in FY23 (+110 Bps YoY)

PAT at INR 16.1 Cr. v/s INR 8.1 Cr. in FY23 (+99.39% YoY)

Promoters’ Analysis

Mr. Ravi Agarwal (Age 38) – Managing Director

Founder member and 1st generation entrepreneur

Holds a 46.6% Stake in the company

12+ years of experience in the telecom sector

Founded Unity Communication in 2010 to provide pocket-friendly quality gadgets

Mr. Nikhil Aggarwal (Age 32) – Whole Time Director

Founder member and 1st generation entrepreneur

Holds a 3.5% Stake in the company

10+ years of experience as a marketing leader

Expertise in developing, executing, and improving marketing campaigns

Proficient in key brand building through market research and insight development

Joined Unity Communication in 2016, focusing on market and business building

To strengthen corporate governance, Mr. Patterson Thomas was appointed as Company Secretary and Compliance Officer in February 2024.

Industry Outlook

In the smartwatch segment of consumer electronics, India surpassed North America, claiming its position as the top region with a 27% share of global smartwatch shipments. Sales in the Indian Smart Watch Market is projected to grow at a CAGR of 20%+ over the next 6 years and is expected to reach INR 75,000 Cr. by 2030

In the smart TV segment, Indian brands showed the fastest growth and had a share of over 25% in smart TV shipments during 2023. It is forecasted that sales in the Indian Smart TV market can reach INR 33,000 Cr. by 2030.

The Indian Smartphone Market is expected to reach INR 60,000 Cr. by FY30 supported by rising affluent users.

The India true wireless (TW) headphone and earphone market is forecasted to reach INR 8,000 Cr. by FY30. This is one of the fastest-growing consumer electronics segments, which is growing at ~20% CAGR.

Investment Thesis

Exceptional Financial Performance:

CGL demonstrated remarkable growth of 59% revenue CAGR and 138% EBITDA CAGR over three years (FY21-23). Strong profitability is evident, with 58% ROE and 64% ROCE, indicating efficient capital utilization.

Strategic Market Positioning:

The company effectively targets India's price-sensitive consumer electronics market, leveraging the sector's rapid growth (15% CAGR in smart TVs, 18% CAGR in smartwatches over the next 5 years) with affordable products.

Robust Distribution Network:

CGL's extensive network of 1000+ distributors and 32,000+ retailers across 28 states forms a solid foundation for growth. The company's omnichannel strategy aims to generate 20-30% of revenue from e-commerce.

Product Portfolio Expansion:

Successful diversification into smart wearables and accessories has driven significant growth (275% and 134% YoY growth in unit sales respectively). The recent entry into home appliances like AC and Washing Machine further expands product reach.

Supply chain Enhancement:

Cellecor incorporated a wholly owned subsidiary in Hong Kong, Cellecor Gadgets HK Limited, a strategic move to enhance supply chain capabilities. This subsidiary will act as a hub for sourcing critical components, benefiting from Hong Kong's logistical infrastructure and business-friendly environment.

Ambitious Growth Strategy:

CGL targets INR 5,000 Cr. revenue within 5 years (projected 100%+ CAGR). Plans include expansion into Tier 3 and 4 cities and international markets, beginning with exports to the UAE.

Valuation and Recommendation

We forecast INR 30.5 EPS for FY26. While the current PE multiple for CGL is ~40x, we conservatively value Cellecor Gadgets Limited (CGL) at 20x FY26 EPS of INR 30.5 per share.

We assign a “Buy” Rating to CGL with an upside of 105% in the next 18-24 months on basis of an extra-ordinary revenue and profitability growth.

Note: The target price post stock split (10:1) is INR 61